Understanding the Different Types and Suitability for Your Business

As a business owner, cashflow can be a constant challenge, and traditional financing options may not always be the best fit. Fortunately, invoice finance offers a flexible and accessible solution for businesses to access cash quickly and improve their cash flow.

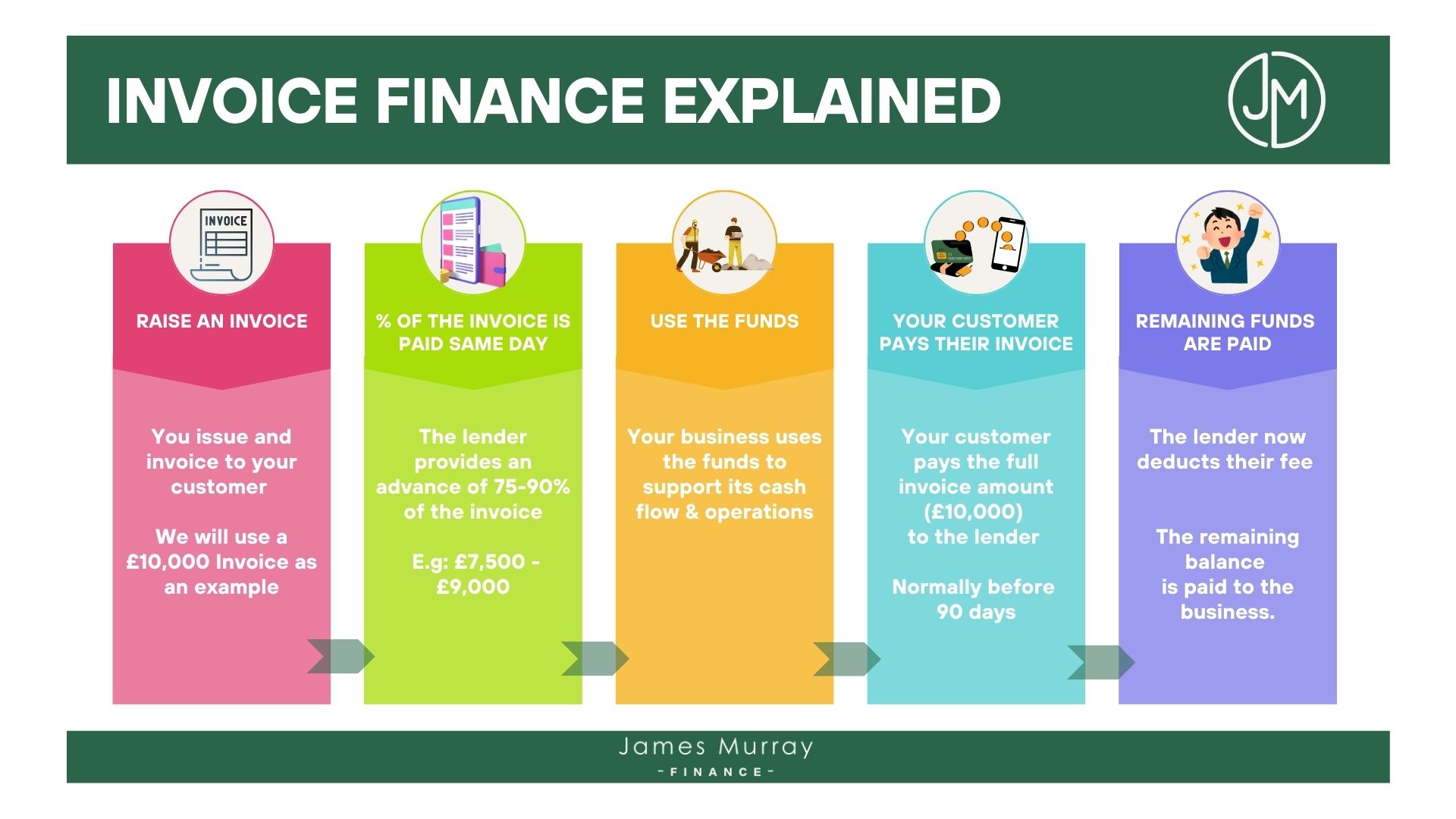

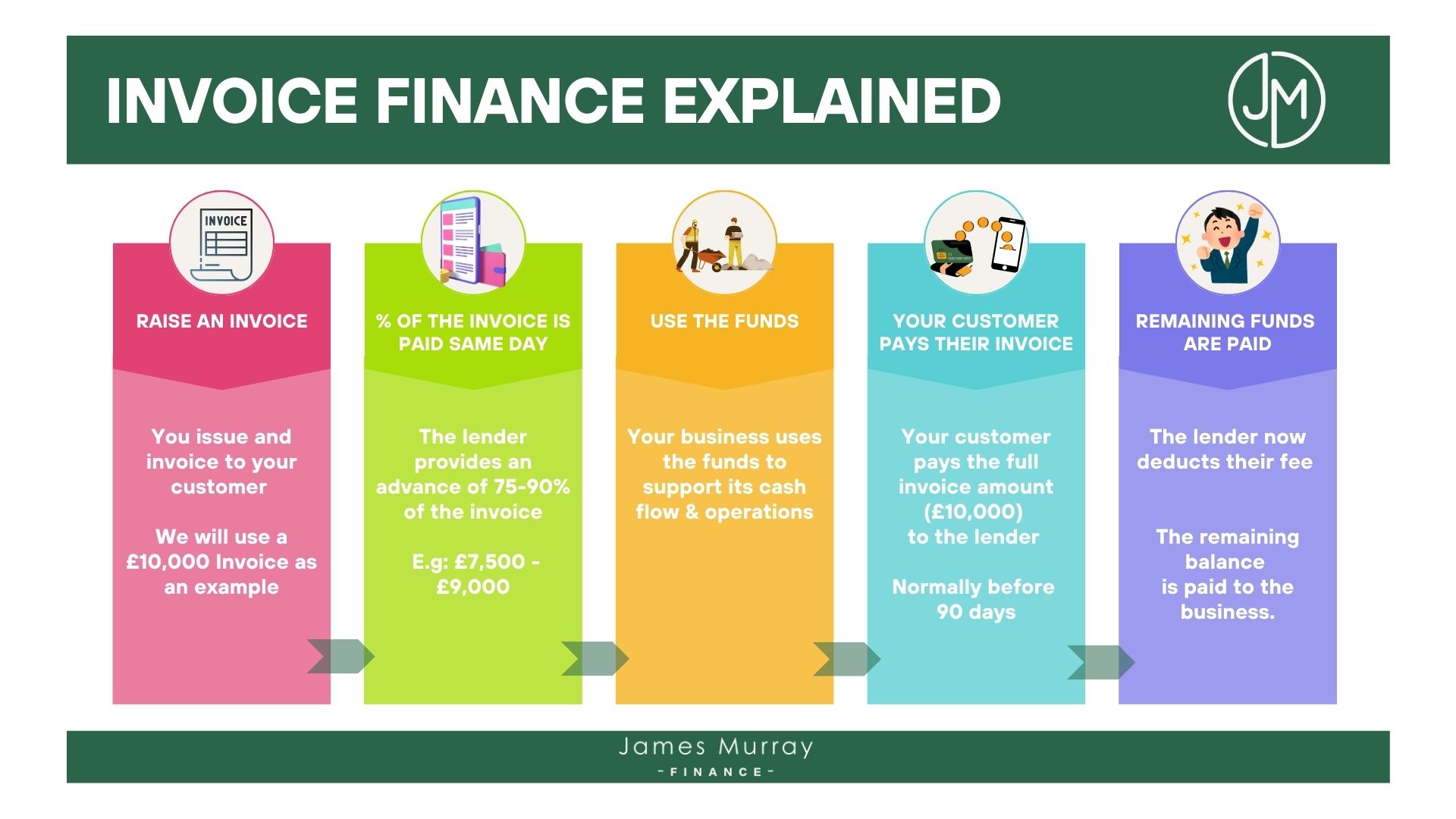

How Invoice Finance Works:

Let's say that an independent business has a customer who owes them £50,000 for goods or services delivered. However, the customer won't pay for another 30 days. This puts the business in a cash flow crunch, as they need that money to pay for their own expenses and keep their operations running smoothly.

To bridge this gap, the independent business could use an invoice finance facility. They would submit the £50,000 invoice to the invoice finance provider, who would then advance them a portion of the value of the invoice (usually around 70-90%).

This means that the business would receive £35,000-£45,000 upfront, which they could use to cover their expenses. Once the customer pays the invoice in full, the lender would return the remaining balance to the business (minus their fees for the financing). The business would have to pay interest and fees on the amount borrowed.

Watch me explain briefly what Invoice Finance is in this short video

You can see from this, that invoice finance can be a valuable source of working capital for businesses that are grappling with their cashflow. Some of the benefits include improved working capital, increased flexibility, and faster access to funds. Invoice finance can also provide businesses with better control over their cash flow by reducing the risk of late payments and bad debts.

However, there are also some potential drawbacks to consider, such as the cost of financing and the potential damage to customer relationships if the financing company takes over the management of the sales ledger.

It's important to carefully consider the pros and cons of invoice finance before deciding if it's the right solution for your business.