Bridging the Gap: How to Overcome Financial Obstacles & Turn Your Dreams into Reality

Embarking on the journey of entrepreneurship often involves facing a series of financial challenges. From securing initial capital to navigating economic uncertainties, the path to business success is fraught with obstacles.

In this article, we'll explore practical strategies for overcoming these hurdles. We'll start by emphasising the importance of crafting a solid business plan, a fundamental tool for securing funding and guiding business growth. Additionally, we'll investigate the significance of personal credit scores in accessing financing options, highlighting their role in demonstrating financial responsibility to lenders.

Furthermore, we'll examine how the impact of having industry experience in your chosen sector can significantly boost your chances of raising capital and delve into finance products such as loans and asset financing, discussing how they can provide additional resources to fuel business expansion.

Mastering the Art of Strategic Planning: Your Blueprint for Start-up Success

In the realm of entrepreneurship, success is not a product of chance but a result of meticulous planning and execution. Central to this process is the creation of a well-crafted business plan, a road map that lays out the path to success. Let's delve into the power of planning and how it can propel your start-up towards unprecedented heights.

1. Crafting Your Blueprint for Success

A robust business plan serves as the cornerstone of your start-up journey. It's not merely a document but a strategic framework that outlines your vision, mission, and objectives. By meticulously detailing your business idea, target market, and competitive landscape, you lay the groundwork for securing funding and attracting investors.

2. Key Components of a Winning Business Plan

A successful business plan encompasses various essential components, each playing a pivotal role in shaping your start-up's trajectory. Market analysis provides valuable insights into industry trends, customer preferences, and potential growth opportunities. Financial projections offer a glimpse into your start-up's financial health, showcasing revenue forecasts, expense estimates, and profit margins. Growth strategies outline actionable steps for scaling your business, whether through product diversification, market expansion, or strategic partnerships.

3. Leveraging Industry Experience for Credibility

In the competitive landscape of start-ups, industry experience can be a game-changer. Whether gained through years of trading in the same sector or by assembling a seasoned management team, expertise installs confidence in investors and lenders. By leveraging your knowledge and insights, you demonstrate a deep understanding of market dynamics and potential challenges, thus enhancing your start-up's credibility and viability.

4. Implementation and Adaptation

A well-crafted business plan is not set in stone but a living document that evolves with your start-up. As you embark on your entrepreneurial journey, be prepared to adapt, and iterate your strategies based on market feedback and changing circumstances. Embrace agility and resilience, turning obstacles into opportunities.

In conclusion, the power of planning cannot be overstated in the realm of start-up success. By meticulously crafting a comprehensive business plan, leveraging industry experience, and embracing adaptability, you pave the way for your start-up to thrive in a competitive landscape.

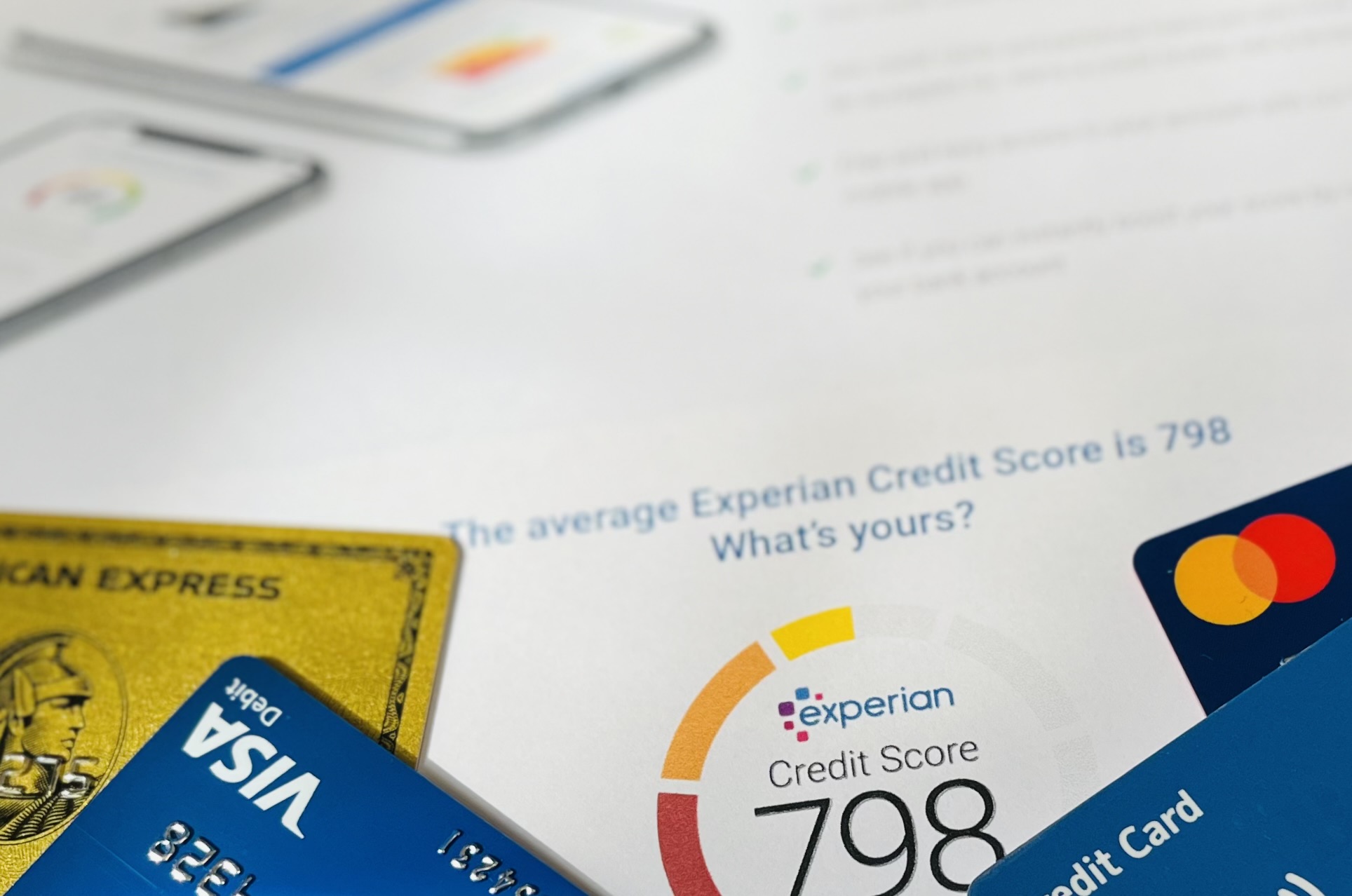

Building a Strong Credit Foundation

Establishing a robust personal credit score is a cornerstone for entrepreneurs, especially in the embryonic stages of business. With limited trading history, entrepreneurs often rely on their personal creditworthiness to secure financing and build credibility with lenders and suppliers. This includes the potential need for personal guarantees and demonstrates a commitment to the venture, instilling confidence in investors and lenders alike.

Moreover, having cash reserves or personal investment demonstrates a tangible commitment to the business and eases pressure in the early days. By cultivating financial discipline and showcasing a strong credit foundation, entrepreneurs not only increase their chances of securing financing but also lay a solid groundwork for long-term success in the dynamic landscape of entrepreneurship.

Navigating Growth Challenges

As businesses expand and evolve, they often encounter a host of growth-related challenges that can strain cash flow and hinder progress. Here's how successful entrepreneurs can navigate these hurdles and propel their ventures towards sustained success:

1. Understanding Cash Flow Crunches 💷

During periods of growth, businesses frequently encounter cash flow crunches due to increased expenses, extended payment terms, or unforeseen costs. These challenges can disrupt operations and impede growth if not addressed proactively.

2. Harnessing Ancillary Finance Products 🏦

Ancillary finance products like invoice financing offer a lifeline for businesses facing cash flow gaps. By unlocking the value of unpaid invoices, entrepreneurs gain immediate access to funds, enabling them to cover expenses, seize opportunities, and fuel growth without waiting for customer payments.

3. Real-World Examples of Success 🏗️

Numerous businesses have successfully leveraged invoice financing to overcome growth-related cash flow challenges. From manufacturing firms scaling production to service-based businesses expanding their client base, invoice financing has proven instrumental in sustaining momentum and seizing growth opportunities.

4. Proactive Financial Management 📊

Effective financial management and planning are critical for anticipating and mitigating cash flow issues. By forecasting expenses, monitoring cash flow trends, and implementing contingency plans, entrepreneurs can navigate growth challenges with confidence and agility.

5. Leveraging Industry Experience 👷

Industry experience and a seasoned management team provide invaluable insights and strategies for navigating growth challenges. Drawing upon their expertise, entrepreneurs can identify opportunities, mitigate risks, and optimise resource allocation, ensuring sustainable growth and long-term success.

In essence, by harnessing ancillary finance products, embracing proactive financial management, and leveraging industry experience, entrepreneurs can navigate growth challenges with confidence and emerge stronger and more resilient than ever before.

So, there it is… In this post we've explored key strategies for entrepreneurial success, focusing on three pivotal elements: "The Power of Planning," "Building a Strong Credit Foundation," and "Navigating Growth Challenges."

I hope you find this useful. My hope is that by implementing these strategies, entrepreneurs can navigate the complexities of entrepreneurship with confidence, laying the groundwork for sustainable growth and long-term success.

Thanks for reading.

James

Disclaimer: This blog post is intended for informational purposes only and does not constitute financial advice. All information is collated at time of writing and the best efforts have been made to ensure accuracy.